Cardiology Billing Made Simple with End-to-End Services

Cardiology Billing Made Simple with End-to-End Services means eliminating confusion, delays, and costly mistakes. Unclear regulations and slow reimbursements can hurt your bottom line, and even one billing error can lead to cash flow disruptions and staff frustration. With a complete end-to-end approach, scheduling, insurance verification, coding, claims submission, and collections are managed seamlessly. Weak points are identified and fixed early. By outsourcing cardiology billing, practices increase cash flow, reduce errors, speed up payments, and allow staff to focus on patient care—making cardiology billing simpler and more reliable.

Table of Contents

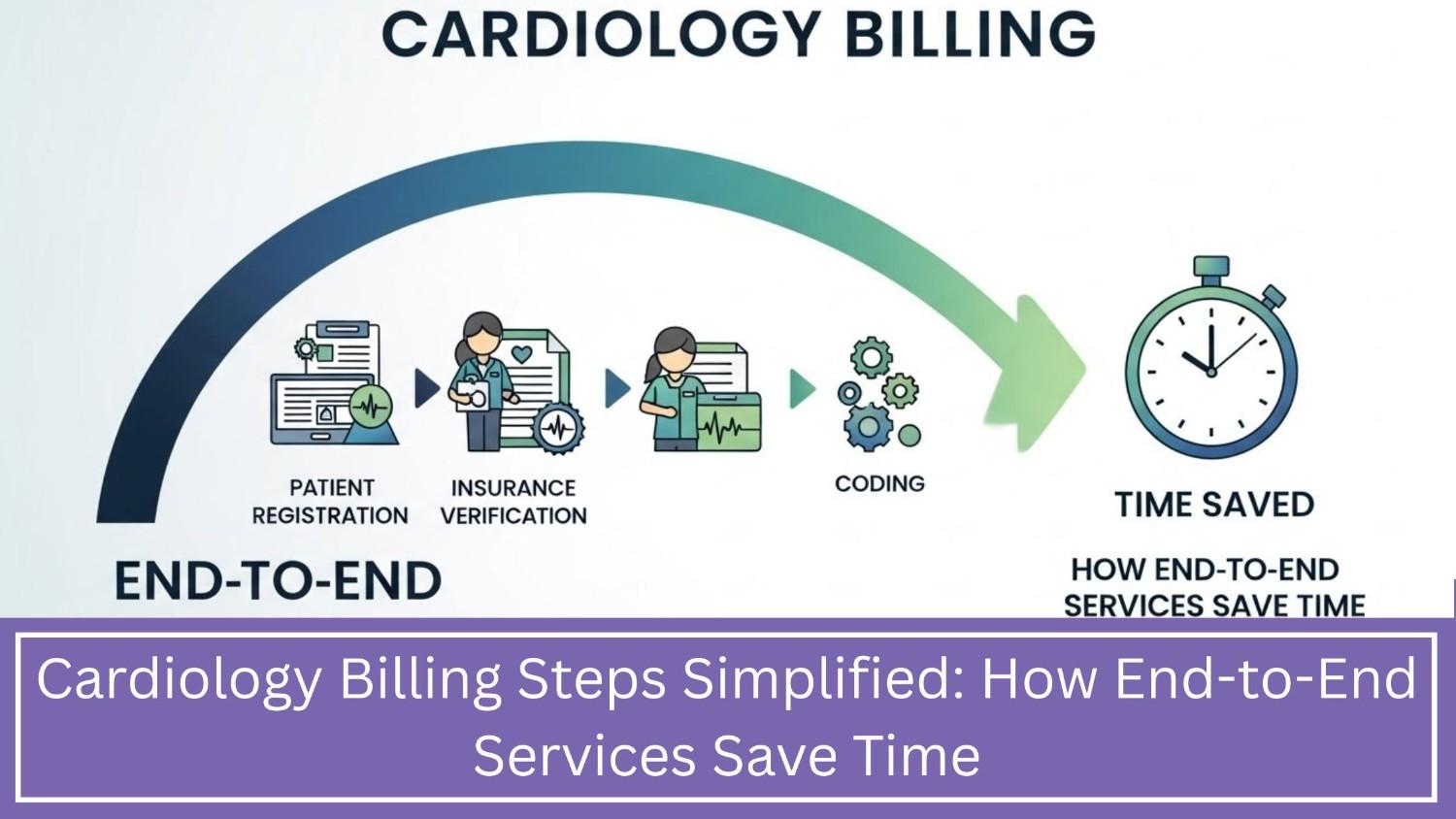

Cardiology Billing Steps Simplified: How End-to-End Services Save Time

Cardiology billing is tough.

Heart care involves tests, treatments, and check-ups—each creating paperwork. Every claim needs correct codes, timely filing, and careful follow-up. One mistake delays payment.

Most cardiology clinics face slow payments, denied claims, and frustrated teams. It’s not about working harder. It’s about working smarter.

This guide explains cardiology billing in plain terms. See how outsourcing cuts delays, reduces errors, and speeds up cash flow.

Let’s fix cardiology billing—starting now.

Why Cardiology Billing Is So Complex

Cardiology is a top-earning field—but billing is its toughest challenge.

Why?

- High-volume procedures per patient

- Costly tests and equipment

- Modifiers needed often

- Tight medical necessity checks

- Payers with clashing rules

The payoff is big, but so is the paperwork.

Common cardiology billing services include:

- Heart rhythm tests (EKG/ECG)

- Treadmill stress tests

- Heart ultrasound scans (echo)

- Artery checks (cath lab)

- Artery supports (stents)

- Heart device checks (pacemakers)

Every service must have the right billing codes, clean notes, and solid proof that it was needed. Data shows cardiology claims get denied 12% of the time—worse than most specialties. One mistake can cost a significant amount of money.

Step 1: Patient Scheduling and Pre-Registration

Billing starts the moment a patient books an appointment.

At this first step, your team needs:

- Full name and birthdate (must match insurance records)

- Current insurance info

- Any referrals or approvals (if required)

Errors here mean delays and denials later.

Why This Step Matters

If insurance isn’t set up right:

- Claims get rejected.

- Payments don’t come in.

- Your team wastes time fixing errors.

- Data shows 1 in 5 denials happen because of eligibility mistakes.

Good medical billing teams catch this fast. They check coverage before appointments and spot problems early.

Step 2: Insurance Eligibility and Benefits Check

Eligibility checks verify three key points:

- Patient has active insurance

- Their copay and deductible amounts

- If cardiology services are covered

Common cardiology plan requirements:

- Prior approval needed

- The doctor must show it’s medically necessary

- Limits on how often it’s covered

Missing these steps? Claims get denied.

Current Trend

In 2025, insurers are cracking down on claims. Automated tools deny them quicker than before. Smart billing teams check eligibility upfront—no nasty shocks at the end.

Step 3: Clinical Documentation

This is how cardiology billing works.

Doctors need to write clear notes about:

- Symptoms (like chest pain or trouble breathing)

- What they found

- Test results

- Why the test was done

Short or unclear notes lead to claim rejections.

For example:

Don’t write just “chest pain.”

Write “ongoing chest pain with stress test showing issues.”

It gets paid faster.

Why Documentation Fails

- Doctors are swamped. Notes get messy. Critical info slips through.

- But insurers need evidence.

- Audits show bad records trigger nearly 1 in 3 heart care rejections.

- Full-cycle solutions scan docs with smart tools to catch missing pieces before billing.

Step 4: Medical Coding

Coding turns patient care into revenue.

For cardiology billing, you need:

- CPT codes

- ICD-10 codes

- Modifiers

- Device codes

Common mistakes:

- Notes and codes don’t align

- Missing modifiers

- Unclear left/right side

- Bundled services billed wrong

Fix these to keep claims clean and payments smooth.

Example of a Common Error

Billing a heart stress test but not tying it to a diagnosed condition? The claim will get rejected—not because the care was bad, but because the paperwork didn’t connect the dots. Smart billing teams use trained coders and follow insurer rules to get claims paid right the first time.

Step 5: Charge Entry and Claim Creation

Once coded, charges need to go in the right place.

Common errors:

- Charges left out

- Charges entered twice

- Wrong dollar amounts

In cardiology, skipping one charge can cost you thousands.

Good news: automation helps. Today’s billing tools cut manual work and catch mistakes fast.

Step 6: Claim Scrubbing and Submission

Before sending claims, check them first.

A good claim review catches:

- Missing details

- Wrong codes

- Insurer rules

This matters. Clean claims get paid faster—25% more often on the first try.

Our service checks every claim with smart tools before it goes out.

Step 7: Payment Posting

Payment posting shows what got paid—and what didn’t.

For cardiology, payments might be:

- Partial amounts

- Insurance changes

- What the patient owes

Doing it by hand slows things down and leads to mistakes.

When payments land late:

- AR drags out

- Short payments slip by

- Chasing slows down

Auto-posting is hot—it gets cash moving faster and cuts mistakes.

Step 8: Denial Management

Denials are inevitable in cardiology billing—but they shouldn’t be frequent.

Top reasons cardiology claims get denied:

- Procedure deemed unnecessary

- Incomplete records

- No prior approval

- Wrong codes

Ignoring denials drains profits fast.

Effective billing solutions target the source of denials—not just the surface issues—to plug revenue gaps for good.

Step 9: Patient Billing and Collections

Patients now owe more upfront than before.

High-deductible plans lead to:

- Bigger patient bills

- More payment questions

- Harder collections

Clear billing statements help.

Strong billing teams deliver:

- Correct charges

- Quick invoices

- Less patient frustration

Better billing builds patient loyalty.

The Real Cost of Fragmented Billing

Many cardiology clinics divide billing work between different teams or outside companies.

This leads to:

- Missed messages

- Slow problem-solving

- Finger-pointing

When no one handles billing start to finish, issues stack up.

The numbers don’t lie:

Clinics juggling multiple billing partners see payments take 15-20% longer to collect.

Why End-to-End Cardiology Billing Works Better

End-to-end cardiology billing keeps it all in one place:

- Eligibility

- Coding

- Claims

- Payments

- Denials

- Reports

The result?

Speedier processes

Less passing the buck

One team owns it all

Time Savings

Practices using full-service billing reports:

- Save 30-40% time on billing tasks

- Fix issues faster

- See reports clearly

Trends Shaping Cardiology Billing in 2026

1. Automation Takes Over

AI now handles:

- Doc checks

- Risk alerts

- Payment processing

Manual billing? Nearly gone.

2. Payers Play Hardball

Insurers want:

- Solid evidence

- Precise codes

- Quick replies

Stay sharp—rules change fast.

3. Value-Based Care Growth

Payments now depend on results. Your billing should show quality care.

4. Patient Experience Focus

Clear bills build trust. Confusing ones push patients away.

Real Results from End-to-End Billing

Cardiology practices with full-service billing see real results:

- AR days drop below 25

- First-pass claims hit over 95%

- Denials shrink

- Cash flow improves

No hype—just proven numbers that move the needle.

Key Takeaways

Cardiology billing can be easy. Here’s how:

- Plan billing before the visit starts.

- Good notes mean faster payments.

- Fewer errors mean less wasted time.

- Tech tools speed things up.

- One team does it better than many.

- Full-service billing keeps things smooth.

Simplify. Get paid.

Conclusion: How Practolytics Simplifies Cardiology Billing

Cardiology billing is complicated—but it shouldn’t slow you down.

Practolytics makes it easy. We handle every step so you don’t have to. Focus on patients, not paperwork.

With us, you get:

- Insurance checks done right

- Strong help with notes and forms

- Correct codes every time

- Claims filed fast, with no mistakes

- Payments tracked quickly

- Fewer denied claims

- Easy-to-read money reports

Less hassle. More time for what matters.

Our blend of smart tech and billing pros helps heart doctors get paid faster, with fewer mistakes and less work.

No more juggling vendors.

No more chasing claims.

Just better results.

Practolytics keeps your cardiology money flowing—now and later.

ALSO READ – Simplifying Revenue Management: How Medical Billing Services Empower Small Practices

Talk to Medical Billing Expert Today — Get a Free Demo Now!